Don't have an account?

Login to EaseMyDeal

2023-12-20

1106

The recent pronouncements by the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) have emphasized the compelling need to maintain a status quo in interest rates, thus preserving the policy repo rate at a consistent 6.50 percent. This unaltered stance spanning five consecutive decisions reflects a strategic response to the complex and multi-faceted economic landscape confronting India.

Despite the International Monetary Fund's (IMF) optimistic outlook on India's economic trajectory, underscored by robust growth projections, the domestic scenario reveals a nuanced narrative. The recently unveiled growth figures for Q2 of 2023-24, as elucidated by the Ministry of Statistics and Programme Implementation (MOSPI), unveil a tale of diverging trajectories within the economy.

The government-led consumption and investment-focused initiatives have stimulated a commendable 7.6 percent headline growth. However, a stark contrast emerges with the private sector's subdued consumption demand, indicated by a marginal uptick of 3.13 percent in Private Final Consumption Expenditure (PFCE) on a year-on-year basis. This narrative paints a picture of unbalanced growth dynamics, raising concerns about potential demand-supply mismatches.

From the supply side, the manufacturing sector, construction, and utility services spearheaded the growth momentum, with agriculture notably lagging behind at a meager 1.2 percent growth. This lackluster performance in agriculture, a sector pivotal during the COVID-19 pandemic, hints at potential implications for demand-supply equilibrium, intensifying concerns regarding inflation.

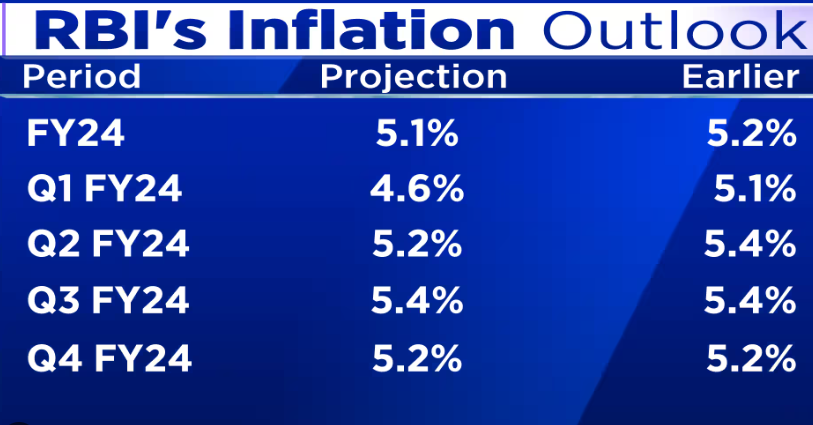

The RBI's cautious approach, rooted in the persistently high inflationary pressures, is evident through the Consumer Price Index – Combined (CPI-C), surpassing the 4 percent mandated target for 50 consecutive months. This sustained breach, with 25 months exceeding the upper tolerance band of 6 percent, signifies the entrenched nature of inflation within India's economic fabric.

Food inflation emerges as a significant contributor, primarily propelled by soaring prices of cereals, pulses, and vegetables. Despite policy interventions, cereal prices have remained in double digits since September 2022, contributing substantially to overall food inflation. Additionally, the resurgence in international crude oil prices, hovering around US$ 80/barrel, poses an additional challenge. With estimates indicating that a 10 percent oil price increase could drive global inflation by 0.35 percent, India's heavy dependence on oil imports underscores its vulnerability.

Furthermore, the surplus in the balance of payments (BOP), leading to increased foreign exchange reserves, injects liquidity into the economy. While crucial for stabilizing currency volatility, this surplus liquidity could potentially amplify inflationary pressures. The looming specter of impending populist measures ahead of the 2024 general elections adds a further layer of concern, potentially inflating aggregate demand and escalating price levels.

Amidst this intricate economic landscape, characterized by erratic weather conditions, global market disruptions, and geopolitical tensions, the RBI's MPC faces the unenviable task of curbing inflationary pressures. A resolute and restrictive monetary policy remains imperative in navigating the perilous economic terrain and averting further inflationary spikes.

As the MPC-RBI treads cautiously, meticulously monitoring both domestic and international economic indicators, the need for a prudent, vigilant, and stringent monetary policy stance remains paramount. The challenges posed by inflation persist, demanding unwavering attention and proactive measures to safeguard India's economic stability and resilience against turbulent global tides

Write A Comment