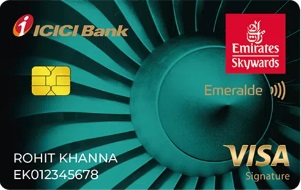

- Earn accelerated Skywards Miles on every spend

- Unlimited complimentary access to domestic and international airport lounges

- Exclusive privileges with Emirates Airlines

- Luxury lifestyle benefits including golf privileges

- Comprehensive travel insurance coverage

- Dining discounts at premium restaurants

- Skywards Miles: Earn 6 Skywards Miles per Rs. 100 spent on Emirates transactions and 2.5 Skywards Miles per Rs. 100 spent on other international transactions. Earn 1 Skywards Mile per Rs. 100 spent on domestic transactions.

- Lounge Access: Unlimited complimentary access to select domestic and international airport lounges.

- Emirates Privileges: Enjoy exclusive benefits such as priority check-in, additional baggage allowance, and special offers on Emirates flights.

- Luxury Benefits: Access to luxury lifestyle privileges including golf benefits and concierge services.

- Travel Insurance: Comprehensive travel insurance including coverage for medical emergencies, trip cancellations, and lost baggage.

- Dining Discounts: Up to 15% off at premium restaurants across India.

Welcome Benefits from Bank

- 10,000 Skywards Miles on payment of the joining fee and first transaction within 60 days.

Free goVIP Platinum Plan for 3 Months

Amazon Prime, Jio Hotstar & 19+ OTT apps for 3 months FREE

Includes: SonyLIV, Zee5, ALTT, Ullu, Sanskar, ShemarooMe, Chaupal Bhojpuri, Dangal Play, FanCode, DistroTV, ShortsTV, PlayFlix, BhaktiFlix, LionsGate Play, OM TV, Dollywood Play, Stage, Runn TV, VROTT.

• Flat 5% cashback on Mobile & DTH Recharge

• Flat ₹500 cashback on Flight & Hotel booking

• Flat 0.1% cashback on Credit Card Bill

• Flat 0.1% cashback on Rent, Fees & Vendor Payments

• Extra 1% cashback on Digital Gold Purchases

• Exclusive ₹1 Hot deals on 20+ Brands

• Extra 1% discount on 500+ Brand Gift Cards

Eligibility Criteria:

- Residency: Must be an Indian resident.

- Age: Between 18 and 70 years.

- Income: Minimum annual income of Rs. 25 lakhs.

- Credit Score: A good credit score, generally above 750.

- Occupation: Available to both salaried and self-employed individuals.

Documents Required:

- Application Form: Duly filled in and signed application form.

- Photograph: Recent colored photograph.

- Identity Proof: Any one of the following – Passport, PAN Card, Driving License, Voter ID Card, Aadhaar Card.

- Residence Proof: Any one of the following – Passport, Driving License, Voter ID Card, Aadhaar Card.

- Income Proof: Latest Payslip, Bank Statement, Form 16, or ITR copy.

How to Apply for ICICI Bank Emirates Emeralde Credit Card?

- Go to the EaseMyDeal website or app & Navigate to the Apply Credit Card section

- Click on ‘Apply Now’ button for the selected credit card

- Enter your Name, Number & Email to get Extra EMD Cashback Benefits and submit OTP

- You will be redirected to the ICICI bank’s official website to fill out the credit card application form

- Enter your personal details, contact information, employment details, etc

- Review all the information provided and ensure it is accurate

- Submit the application form

ICICI Bank Emirates Emeralde Credit Card FAQs

The joining fee is Rs. 12,000, which is waived on spending Rs. 15 lakhs in the preceding year.

Earn 6 Skywards Miles per Rs. 100 spent on Emirates transactions, 2.5 Skywards Miles per Rs. 100 spent on other international transactions, and 1 Skywards Mile per Rs. 100 spent on domestic transactions.

Unlimited complimentary access to domestic and international airport lounges and exclusive privileges with Emirates Airlines.

Yes, the card offers luxury lifestyle benefits including golf privileges.

Receive 10,000 Skywards Miles on payment of the joining fee and first transaction within 60 days.